The MPC decided this morning to keep the bank’s policy interest rate unchanged, leaving the rate on seven-day term deposits at 4.50%, where it has been since last November.

Today’s MPC statement is ever so slightly softer in tone than its immediate predecessors. As before, though, the Committee confirms its willingness and capacity to contain inflation and inflation expectations. In particular, the statement says that “[t]his could call for a tighter monetary stance in coming months.” The previous wording was as follows: “If inflation expectations continue to rise and remain persistently at a level above the target, it will call for a tighter monetary stance.” (our emphasis)

This change in pitch is presumably due to the decline in the breakeven inflation rate and inflation expectations since the last policy rate decision, which means that the monetary stance as measured by the real policy rate has tightened once again. In the recent past, the MPC has expressed mounting concern about the rise in inflation expectations, so this new development must be a relief — at least for the present.

Another change in the Committee’s forward guidance is the increased emphasis on the impact of the labour market and fiscal policy on the need for monetary tightening in the short run. The sentence that pertains now reads as follows:

Other decisions, particularly those relating to the labour market and fiscal policy, will be important in determining whether that will be the case (i.e., whether the monetary stance will be tightened) and will affect the sacrifice cost in terms of lower employment.

The previous version of that sentence was as follows:

Other decisions, particularly those relating to the labour market and fiscal policy, will affect the sacrifice cost in terms of lower employment.

In other words, the MPC is fairly unambiguous in its warning that wage settlements that are inconsistent with a reasonable degree of medium-term price stability or that significantly weaken the fiscal stance will result in a policy rate hike. This risk factor has supplanted inflation expectations as the chief thorn in the side of the MPC, if today’s statement is any indication.

Bleaker economic and inflation outlook in 2019

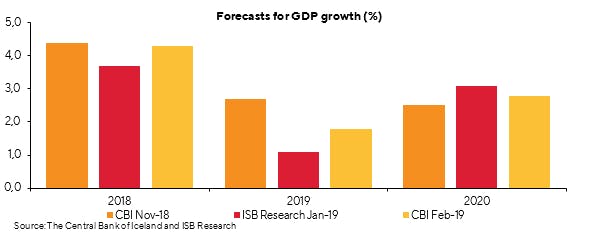

The CBI’s new macroeconomic forecast provides for much weaker GDP growth (1.8%) this year than the last one did (2.7%). The main difference between the two is the projected contraction in services exports in the new forecast. GDP growth is forecast at 2.8% in 2020 (up from 2.5% in the previous forecast) and 2.6% in 2021. The bank therefore projects the next three years’ average GDP growth rate to be much lower than the average of the past three years.

On the other hand, the inflation forecast is more downbeat than its predecessor. The CBI now projects that inflation will peak at 3.8% in Q3/2019 and will not fall back below the target until the end of 2020, whereas in the previous forecast, inflation was expected to peak at 3.5% in H1/2019 and realign with the target in mid-2020. The new forecast is quite like our own most recent inflation forecast, and the macroeconomic forecast is also rather similar to ours.

As a result, there is a tug-of-war between key assumptions for the Taylor rule, which estimates the optimum policy rate and is at the core of the CBI’s macroeconomic model, in that the output gap will close faster than before, while inflation will be higher.

CBI expects only a small CA surplus

The CBI is much more pessimistic than we are on developments in external trade. The bank forecasts that the current account surplus will shrink to 0.5% of GDP this year and remain close to that level for the two years afterwards. If that forecast materialises, there will be precious little in the way of inflows from the current account surplus to offset expected outflows stemming from pension funds’ foreign investment. Such investment-related outflows would then have to be financed predominantly with foreign borrowing and/or investment inflows. This should encourage the CBI to lower the special reserve requirement on capital inflows to zero sooner rather than later, so as to facilitate such inflows. No mention was made of this in connection with today’s policy rate decision, however.

In spite of the poorer outlook for the current account surplus, the CBI projects that the ISK will appreciate slightly over the forecast horizon. At this morning’s press conference on the policy rate decision, it emerged that based on current developments and prospects, the ISK is somewhat below its equilibrium real exchange rate. In our opinion, this should further encourage the CBI to move ahead and lift the remaining controls on investment inflows, as residents’ interest in investing abroad could easily hold the ISK below that equilibrium value if there are insufficient offsetting inflows.