Inflation has fallen by 0.8% in 2019 to date. The exchange rate pass-through from the depreciation of the ISK last autumn appears to be weaker than might have been expected. The impact of house prices on inflation has subsided steadily as well. The inflation outlook for the quarters to come is reasonably good, provided that this spring’s wage rises are not excessive.

Inflation continues to ease

Inflation has fallen by 0.8% in 2019 to date. The exchange rate pass-through from the depreciation of the ISK last autumn appears to be weaker than might have been expected.

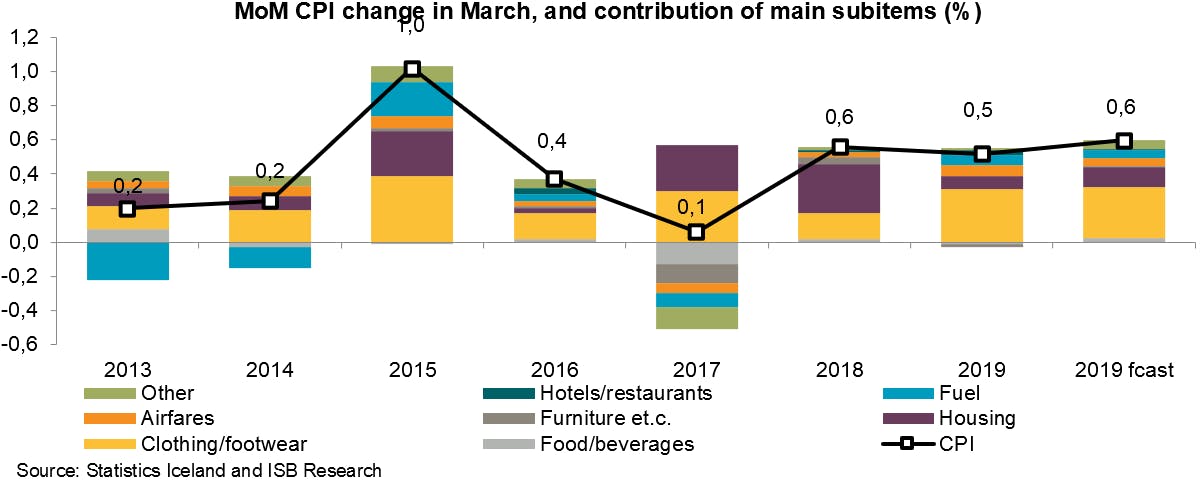

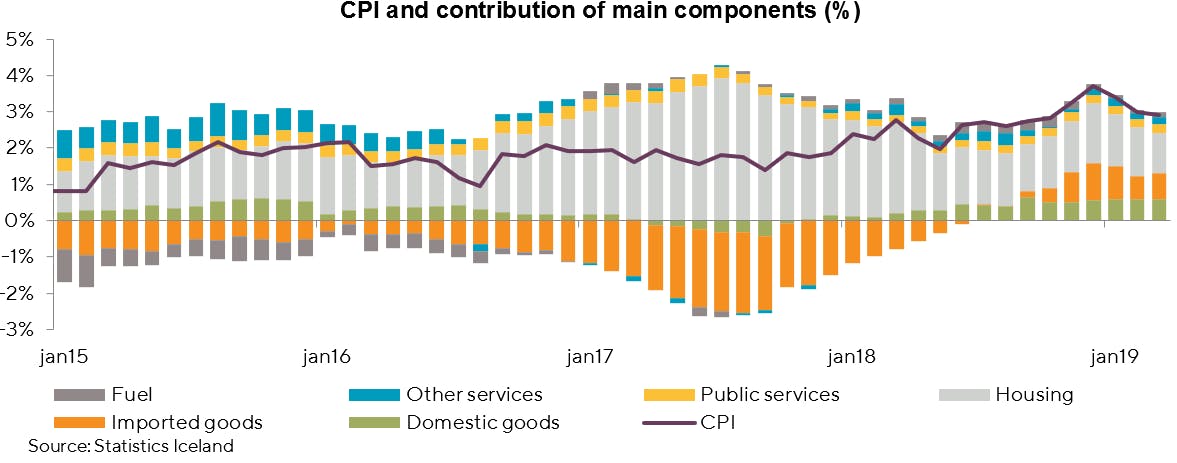

According to figures released recently by Statistics Iceland (SI), the consumer price index (CPI) rose 0.52% month-on-month in March, lowering twelve-month inflation to 2.9% from 3.0% in February. Inflation has therefore fallen by 0.8% since end-2018, when it measured 3.7%. However, the CPI excluding housing rose by 0.66% during the month, and twelve-month inflation thus measured was 2.4%. The difference between these two measures of inflation is now at its smallest since autumn 2013, reflecting dwindling inflationary pressure from house prices.

The March CPI measurement is at the low end of official forecasts. We had projected a rise of 0.6% between months, whereas forecasts as a whole lay in the 0.5-0.7% range. The difference between our forecast and SI’s measurement lies partly in a smaller-than-expected rise in the housing component and a marginal decline in the culture and recreation component, as well as in housewares prices.

Impact of ISK and house prices subsiding

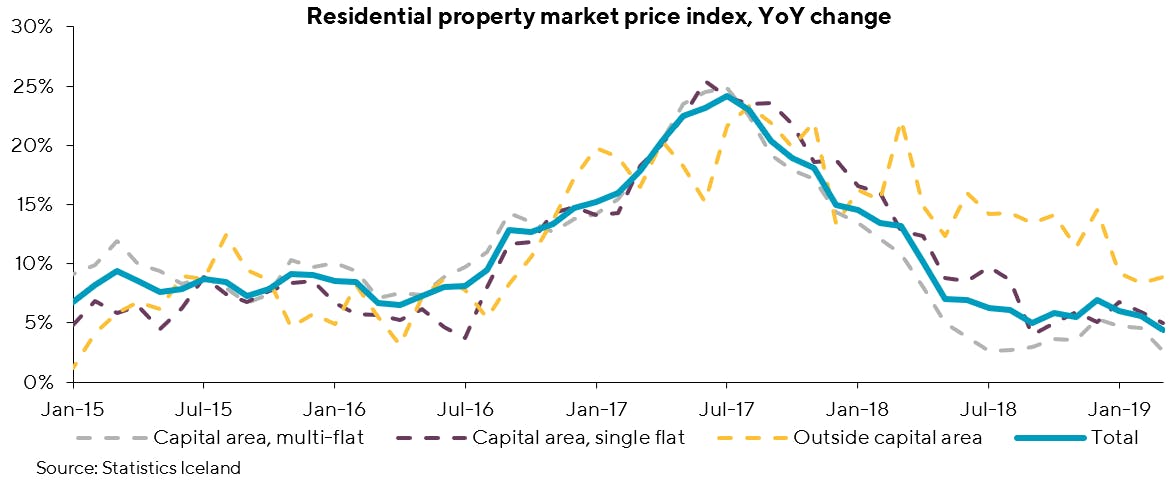

House price inflation has been easing steadily in the recent past, with a growing housing supply and declining demand pressures in the market. By the same token, the share of house prices in overall inflation has fallen. This trend has continued in the March CPI measurement.

House prices overall rose by 0.3% month-on-month, according to SI measurements, which are based on purchase agreements finalised between December 2018 and February 2019. Twelve-month house price inflation therefore measures 4.4%, its weakest in six years. In keeping with the recent pattern, prices in regional Iceland rose faster than those in greater Reykjavík, with the twelve-month increase in regional Iceland now just under 9% and the price of capital area single-family homes and condominiums up by 5% and just under 3%, respectively, over the same period.

End-of-sale effects made a strong impact on the March CPI measurement. For example, clothing and footwear were up nearly 10% MoM (0.31% CPI effect), although it should be noted that end-of-sale effects on clothing prices were virtually non-existent in February. With this last rise, clothing prices are roughly where they were before January sales began.

In general, the exchange rate pass-through from the ISK depreciation in H2/2018 is more moderate than we had expected. Imported food and beverages, for instance, have risen in price by 2.8% in the past twelve months, clothing by 1.2%, and furniture and housewares by 3.0%. Yet over this same period, major currencies have appreciated by 11% against the ISK. It appears as though importers and imported goods merchants have absorbed a sizeable share of the cost increases that inevitably follow a currency depreciation.

Stiffer competition and uncertainty about demand have doubtless played a role in this, but for households it has to be good news, as purchasing power has been more resilient than is usually the case when the ISK weakens at the end of the business cycle.

Inflation outlook reasonably good, but prospects for wage pressures are uncertain

The outlook is for inflation to hold broadly steady in the near term. We expect the CPI to rise by 0.2% in April, 0.2% in May, and 0.3% in June, leaving headline inflation at 3.1% in June.

Airfares can be expected to spike around Easter, and again in the summer. Imported inflation due to rising goods prices should continue to taper off as the summer approaches, assuming that the ISK holds its ground. We also expect house prices to rise at roughly the current pace in coming months.

In general, it can be said that the inflation outlook has improved somewhat in the recent term. The aftereffects of last year’s currency depreciation are tapering off, and house prices are rising more slowly than before. Competition in the retail market has been a factor as well. As a consequence, inflation could remain within striking distance of the target in the coming term. In our opinion, the biggest uncertainty in this regard is wage developments. If pay rises are larger than the economy can handle successfully, the cost increases will inevitably be passed through to goods and services prices. Another question mark centres on the ISK and how it responds to the uncertainty currently roiling the tourism industry, although we think those effects have already surfaced for the most part.