Households hit the brakes

In real terms, Icelandic households’ payment card turnover growth hit a six-year low in Q1/2019.

In real terms, Icelandic households’ payment card turnover growth hit a six-year low in Q1/2019. Card-based spending abroad has made a u-turn since last autumn, after growing rapidly in the period beforehand. Private consumption looks set to grow much more slowly in 2019 than in previous years.

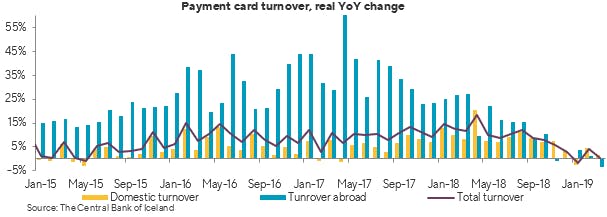

According to newly published payment intermediation figures from the Central Bank (CBI), turnover on domestic payment cards totalled just over ISK 85bn in March, an increase of 4.5% year-on-year. Turnover deflated with the CPI excluding housing and the trade-weighted exchange rate index shows, however, that households’ domestic card turnover grew by only 1.5% YoY in real terms in March, while overseas turnover contracted by more than 3%. On the whole, households’ card turnover grew by 0.6% between March 2018 and March 2019.

Abrupt downshift in 2019

Because payment card turnover figures tend to fluctuate widely form one month to another, it is useful to examine quarterly numbers. In Q1/2019, for instance, turnover in Iceland grew by 1.1%, while overseas turnover rose by 0.4%. In all, households’ turnover grew by 0.9% in real terms in Q1, the slowest growth rate since Q4/2012.

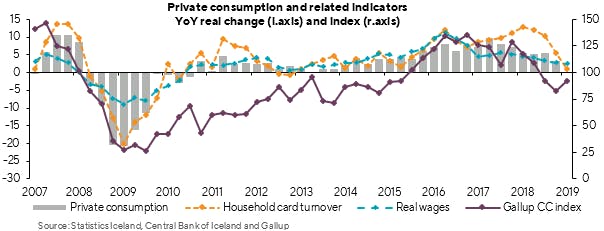

These figures indicate clearly that households have been clutching their wallets tighter in recent months. This should come as no surprise, though: the economic outlook has clouded over in recent quarters, consumer confidence in the economy and labour market has imploded, real wage growth has slowed, and population growth has eased. In many respects, it is good that households responded by consolidating instead of taking on additional debt to finance spending, once it became clear that real wage growth was slowing and economic uncertainty mounting.

Consumption growth set to be weak in 2019

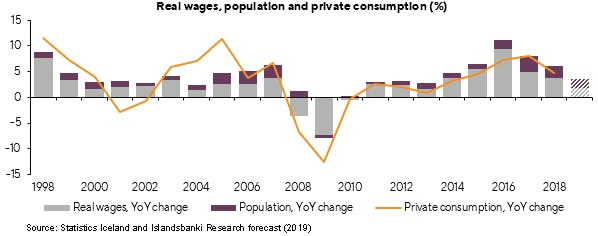

We think the above-described developments in card turnover have set the stage for this year’s private consumption pattern. Population growth will probably be much weaker this year than in the recent past. Furthermore, workers at or above average income levels will probably see little or no real wage growth if the newly negotiated wage agreements are approved — wage agreements that will set the tone for the contracts still pending. Unemployment will also be somewhat higher in 2019 than in the past few years. And last but not least, consumer sentiment about the economic and labour market outlook is considerably more downbeat than it has been in recent years.

The next few months’ developments in the tourism sector and the labour market will be a major determinant of developments in private consumption later this year. We think it likely, though, that sentiment will improve somewhat over time and that private consumption growth will gradually recover. Even so, the growth rate for 2019 as a whole will presumably be much slower than in the past few years. In our macroeconomic forecast, published in January, we projected year-2019 private consumption growth at 2.7%, the weakest in six years. Based on the figures above and developments since we issued that forecast, our projection is on the high side, if anything.