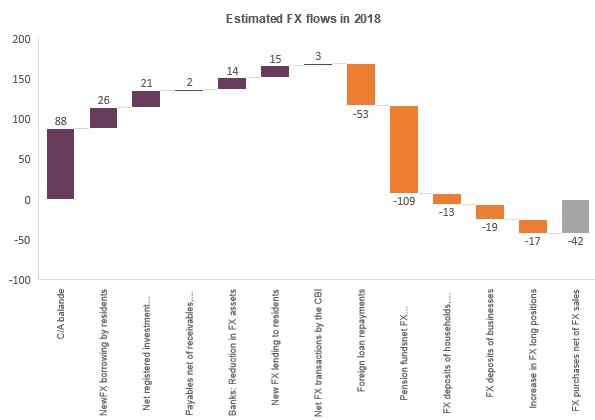

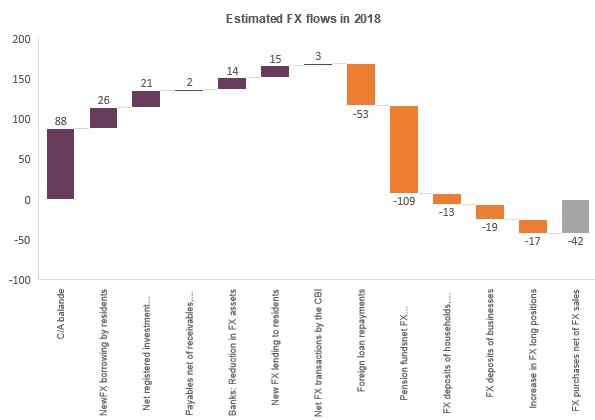

As in previous years, FX inflows relating to the current account balance were quite strong in 2018, totalling ISK 88bn, according to CBI estimates. In addition to this were inflows through the financial account, including new foreign borrowings (ISK 26bn), a net increase in new inward foreign investment (ISK 21bn), foreign-denominated lending by the banks and a reduction in their FX assets (ISK 29bn), and other smaller items (ISK 5bn).

The largest offsetting outflows, according to CBI data, were the pension funds’ FX purchases, which totalled ISK 109bn. Households’ and businesses’ FX deposits increased by ISK 31bn, and the banks’ long positions against customers’ forward contracts increased by ISK 17bn. Instalments paid on foreign loans amounted to ISK 53bn.

To cut a long story short and simplify it considerably, it can be said that allocation of savings out of the ISK, plus net foreign loan repayments, more than offset the current account surplus and investment-related inflows last year.

FX piggy banks emptied during Advent

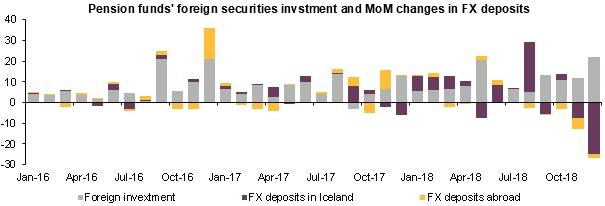

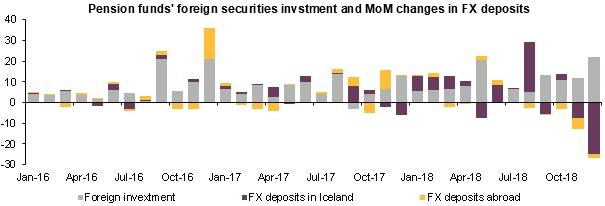

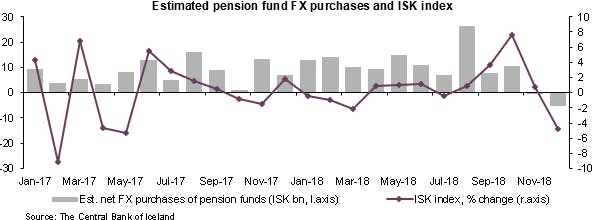

Icelandic pension funds bought foreign currency for ISK 110bn in 2018, about ISK 9bn less than in 2017. As the chart shows, however, the allocation of foreign currency differs from one period to another. For the first seven months of the year, the pension funds’ FX deposits with domestic banks increased by an average of just over ISK 3bn per month, whereas their investments in foreign securities averaged just under ISK 8bn per month. In August, however, the pension funds increased their FX deposits by ISK 24bn. In other words, they increased their deposits more in that one month than in the previous seven months combined. Most of these deposits were used for securities purchases in December, as the pension funds bought less currency in the last four months of the year than in the months beforehand.

But the pension funds were not the only parties to stockpile foreign currency during the autumn. Of the more than ISK 30bn increase in households’ and businesses’ FX deposits in 2018, about half of it occurred in the autumn.

Is further weakening of the ISK in the offing?

It is clear that because of WOW Air’s collapse and the resulting decline in tourist arrivals, the current account balance will be less favourable this year than previously projected. In our opinion, however, it is not a given that current account surpluses are a thing of the past.

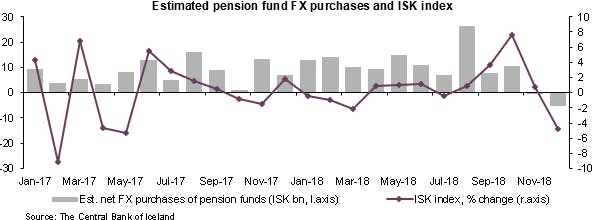

The prospect of a smaller surplus should put downward pressure on the real exchange rate, all else being equal. Furthermore, it should be borne in mind that the pension funds and other investors will continue to diversify risk by investing abroad in coming years. These outflows will probably exceed the current account surplus in the coming term.

But we think it unwise to jump to the conclusion that the ISK will inevitably weaken in the quarters to come. It weakened significantly in 2018 despite a sizeable current account surplus, with resident entities accumulating large amounts of foreign currency in the latter half of the year, as the figures above show. In February 2019, the real exchange rate in terms of relative consumer prices was a full 8% lower than in February 2018. It is now roughly where it was in late summer 2016. It is therefore much closer to equilibrium than it was early in 2018. In fact, we think it is within striking distance of some sort of short-term equilibrium level.

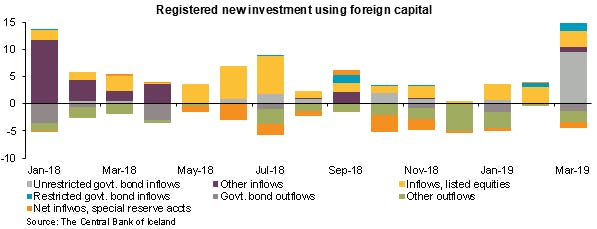

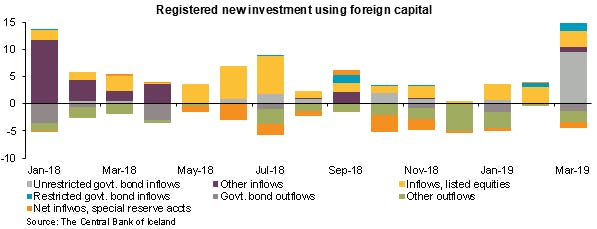

In addition, there is a good chance that inward foreign investment will be substantial in coming quarters. According to the CBI’s Financial Stability report, net inflows due to foreign investment in domestic securities totalled ISK 9bn in March. The CBI’s capital flow management measure, which reduced the incentive for non-residents to invest in Icelandic bonds and deposits, was reset to zero in early March, and this move has clearly had an impact.

Zeroing in on the coveted middle ground?

Under free movement of capital, it is both appropriate and important that investment flows to and from the country be reciprocal. Although it is certainly a positive thing that national saving outpaced investment and Iceland’s international investment position has improved steadily in recent years, we think foreign currency needs for the allocation of savings outside the Icelandic economy will be met to an increasing degree with inflows from investments and foreign loans granted to Icelandic borrowers. As a result, it should be possible to approach the sweet spot — the middle ground between retaining strong purchasing power internationally in the present, and preparing for the future with internationally diversified long-term savings.