At its May meeting, the MPC voted unanimously in favour of a 50-bp rate cut, citing the marked deterioration in the economic outlook as portrayed in the CBI forecast published concurrent with the interest rate decision. In addition, the inflation outlook had improved relative to previous forecasts, in the CBI’s opinion, and inflation expectations had fallen. And last but not least, the MPC emphasised the considerable scope it had to respond to economic headwinds, provided that inflation and inflation expectations remained moderate.

CBI to lower policy rate on 26 June

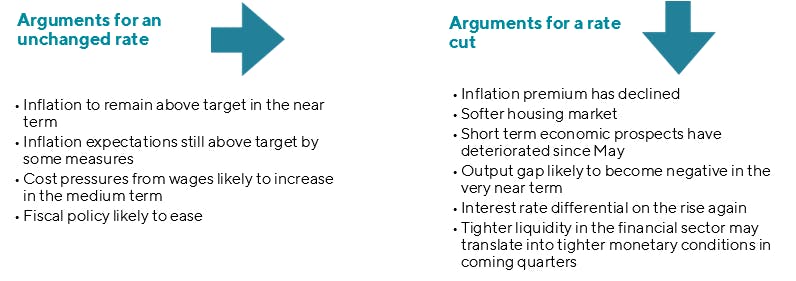

We expect the Central Bank (CBI) Monetary Policy Committee (MPC) to announce a 25-point reduction in the CBI’s policy interest rate on 26 June, the next interest rate decision date. The CBI’s key interest rate — the seven-day term deposit rate — will then be 3.75%, its lowest since Q3/2011.

Summary

We forecast a 25-point rate cut on 26 June

Policy rate will fall to 3.75%

Inflation outlook more than acceptable; inflation expectations moderate

Short-term economic outlook has clouded over in recent weeks

Further rate cuts totalling 50 bp likely in H2/2019

In our opinion, the economic outlook has deteriorated more since the May interest rate decision than was depicted in the baseline forecast published by the CBI at that time. As a result, an output slack will probably open up before the end of this year and could take longer to close again than the CBI projected in May. The MPC’s statement and other comments by its members also suggest strongly that the Committee is ready to lower interest rates further in response to economic headwinds — and presumably, there is little reason to wait, as recent economic indicators have been consistent with the above-specified criteria concerning inflation expectations and prospects. And finally, recent developments in long-term breakeven inflation rates and inflation expectations indicate that the monetary policy is still retaining its overall credibility, which reduces the need for monetary tightening, absent other changes.